Services Include

Federal and State income tax

Corporate and partnership tax issues

Sales and use tax

Estate and gift tax

Real estate tax issues

International taxation issues

Employee benefits and ERISA matters

Get Started

Choose your point of contact.

We have a few staff members who specialize in this service. To learn more about them, click their profiles below!

Our Practice Areas

Business

Our team will give efficient counsel for your business and the various things that affect businesses like employment, sales reps, intellectual property, etc.

Finance

SFBBG is leading the industry in providing excellent counsel for financial services such as banking & creditor rights, estate planning, probate, and trust.

Litigation

We zealously litigate, arbitrate and mediate. Nothing drives a favorable outcome more than readiness for a smooth and successful trial. We're here to help!

Real Estate

Our attorneys are trusted counsel and business advisors with a broad range of real estate expertise to serve the firm’s sophisticated clientele.

Ready to hire strategic counsel?

“One of the best features of SFBBG is the emphasis placed on establishing long-term relationships with clients, relationships that will often lead to our serving as outside, inside counsel.”

News & Updates

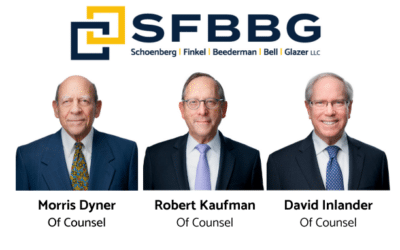

SFBBG Deepens Service Offerings with Addition of Skilled Attorneys from Fischel Kahn

Morris Dyner, David Inlander, and Robert Kaufman bring decades of experience in estates and trusts, family law, and complex corporate transactions.

Schoenberg Finkel Beederman Bell Glazer LLC has been ranked in Illinois Chambers Spotlight 2025 Guide and recognized as a top small firm handling high-quality work.

SFBBG was selected based on an independent and in-depth market analysis, coupled with an assessment of our experience, expertise and caliber of talent.

Illinois Supreme Court Rules in Favor of SFBBG Client in Defamation Case

On November 21, 2024, the Illinois Supreme Court issued its decision in the case Glorioso v. Sun-Times Media Holdings, LLC, (2024 IL 130137). SFBBG and its attorney Phil Zisook represent the Plaintiff in the case, Mauro Glorioso, the former Executive Director and General Counsel of the Illinois Property Tax Appeals Board (“PTAB”).