One of the newly enacted laws SFBBG has been following closely is the Corporate Transparency Act (the “CTA”), a federal statute that impacts the overwhelming majority of our clients. A discussion of the CTA can be found in our November newsletter.

One of the newly enacted laws SFBBG has been following closely is the Corporate Transparency Act (the “CTA”), a federal statute that impacts the overwhelming majority of our clients. A discussion of the CTA can be found in our November newsletter.

Contributors: Andrew Johnson, Caleb Haydon

In 2024, the employment landscape in Illinois, particularly in Chicago, will undergo a significant transformation with the implementation of two pivotal laws governing paid leave for workers. The Illinois Paid Leave for All Workers Act (the “Act”) introduces a comprehensive state-wide standard for paid leave, ensuring a minimum of forty hours annually of paid leave—which can be used for any reason—for all employees.

Contributors: Len Gambino, Marc Pawlus

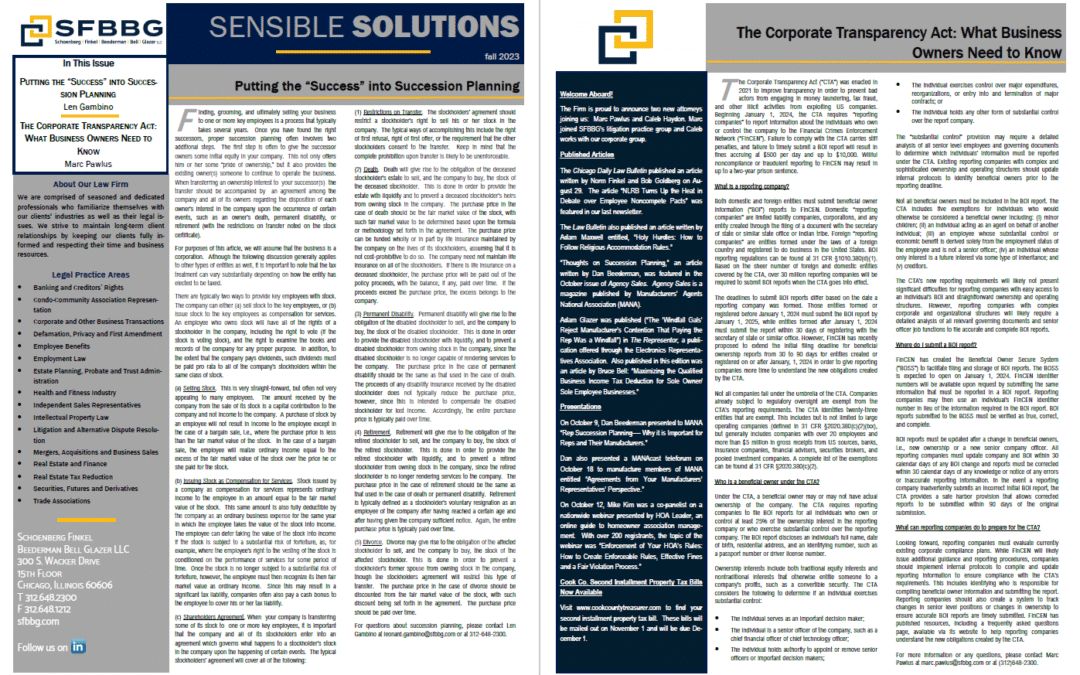

The Corporate Transparency Act (“CTA”) was enacted in 2021 to improve transparency in order to prevent bad actors from engaging in money laundering, tax fraud, and other illicit activities from exploiting US companies. Beginning January 1, 2024, the CTA requires “reporting companies” to report information about the individuals who own or control the company to the Financial Crimes Enforcement Network (“FinCEN”).

Finding, grooming, and ultimately selling your business to one or more key employees is a process that typically takes several years. Once you have found the right successors, proper succession planning often involves two additional steps.

Contributors: Norm Finkel, Robert Goldberg, Kelly Cronin

What is ChatGPT and How Will It Affect My Business?

Business owners should be aware of the benefits and legal pitfalls that lurk under the world of Artificial Intelligence (“AI”).

We recently shared with you the details of a trade regulation rule proposed by the Federal Trade Commission banning non-compete agreements.

Suppose you were asked to design the most taxpayer-friendly retirement plan possible. If given a choice, you would want a plan that allows for generous annual contributions. The contributions would be tax-deductible, regardless of whether or not you itemize deductions and regardless of your earnings or taxable income.