Resources

Stay in the know of company and industry updates, accomplishments and more!

Illinois’ 2026 Employment Law Changes: Employers Should Prepare to Overhaul Key Workplace Agreements and Policies

By Adam C. Maxwell and Adam N. Hirsch

Tax Deductions for Your Home Office

When Family Agreement is Breached, Neither Rep’s Wife Nor Principal Gets Off “Scott”-Free

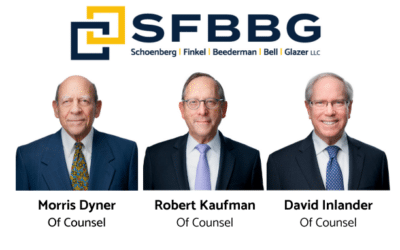

SFBBG Deepens Service Offerings with Addition of Skilled Attorneys from Fischel Kahn

Morris Dyner, David Inlander, and Robert Kaufman bring decades of experience in estates and trusts, family law, and complex corporate transactions.

Cook County Property Tax Bills Likely Delayed Again

SFBBG reported on May 14, 2025, that Cook County’s second installment property tax bills for the 2024 (payable 2025) tax year are expected to be issued at least one month late.

Corporate Transparency Act Update: Beneficial Ownership Information Reporting Removed for U.S. Companies and U.S. Persons

Financial Crimes Enforcement Network (FinCEN) has issued an interim final rule that removes the requirement for U.S. Companies and U.S. persons to report the Beneficial Ownership Information (BOI) required under the Corporate Transparency Act (CTA).

Corporate Transparency Act Update: Beneficial Ownership Information Reporting Enforcement Halted, with Deadline Extensions

Financial Crimes Enforcement Network (FinCEN) previously announced that Beneficial Ownership Information reporting requirements under the Corporate Transparency Act (CTA) are in effect, with an extended deadline of March 21, 2025.

When Is a Noncompete Not Treated Like a Noncompete? / New Year, New Illinois Laws: What Every Employer Needs to Know (Winter 2025)

Avoiding Probate — Why You Need an Estate Plan

Last quarter I explained the probate process and promised this quarter to write about how to avoid probate and to explain the advantages of preparing a revocable trust-based estate plan.

The Case of the Contract Formed by E-mail

Latex foam sales rep Kevin Callinan, a fixture in the mattress industry, was starting to contemplate retirement. Shevick Sales Corp. (SSC), owned by industry acquaintance Karl Shevick, sold latex mattress toppers.